Read the rest of the post ' Hiscox Re & ILS becomes Hiscox Re and launches Hiscox Capital Partners '

Managing the reinsurance cycle

![]() Introduction

Introduction

Effectively managing the reinsurance cycle is a key element of optimising reinsurance portfolio construction and ensuring long-term profitability.

By understanding the cyclical nature of the reinsurance market and implementing strategic adjustments, portfolio managers can enhance their risk management practices, capitalise on favourable market conditions and mitigate potential losses during downturns.

This white paper explores the key drivers of reinsurance portfolio performance, the impact of market fluctuations, and best practices for navigating the pricing cycles that overlay the main

driver of portfolio performance: natural catastrophes.

The reinsurance cycle

At its core, the reinsurance pricing cycle refers to the recurring pattern of rising and falling prices

for reinsurance coverage, typically oscillating between ‘soft’ and ‘hard’ markets. In a soft market, capacity (reinsurance capital) is abundant, competition among reinsurers is fierce, and pricing tends to decline, often resulting in broader coverage terms and more relaxed underwriting standards. This environment may entice insurers to purchase more reinsurance protection but can also lead to under-pricing of risk and thinner margins for reinsurers.

Conversely, a hard market emerges after significant industry losses, capital constraints, or shifts in risk perception. During these periods, reinsurance capacity contracts, pricing rises sharply, terms and conditions become stricter and underwriting discipline intensifies. The transition to a hard market is often abrupt, triggered by events such as catastrophic natural disasters, capital market shocks, or regulatory changes that reduce available capital or heighten uncertainty.

The duration and amplitude of each phase in the cycle can vary, influenced by factors such as macroeconomic trends, catastrophic loss events, investment returns, regulatory interventions, and alternative capital flows (e.g., insurance-linked securities). Portfolio managers must therefore remain vigilant, continuously monitoring market signals and adapting strategies to balance risk and reward through each stage of the cycle.

The reinsurance market has been in a very hard phase for the last two years; characterised not only by elevated pricing but also by reinsurance structures that demand significantly higher retentions from cedants.

While pricing receives considerable attention and is starting to show signs of some softening, the architecture of reinsurance structures – such as attachment points, limits, and coverage terms – plays an equally pivotal role in determining overall portfolio performance. Market signals currently indicate that retentions generally remain elevated, and in some wildfire-affected cases, retentions are increasing.

Drivers of performance

Hiscox Re’s portfolio of natural catastrophe risk, available in our sidecar, has delivered a long-term return of 10.0% annualised compared to an expected mean annualised return of 9.3% over three decades. This illustrates our effective management of both the reinsurance cycle and catastrophic events. The exhibit below illustrates the mean expected return and range of expected outcomes for each year in the grey boxes - the range illustrated reflects catastrophe loss activity running from 50% to 200% of expectation. The red dots indicate the actual annual portfolio result for our sidecar on a year of account basis.

___________________________________________________________________________________________

Cat portfolio actual vs expected returns

n 50%-200% of expected loss

n Actual return

If years are classified as having a market state in either a ‘hard’ or ‘soft’ phase of the pricing cycle, there is a degree of correlation with actual portfolio outcome. However, this correlation is dwarfed by the impact of event volatility.

Years that show results falling outside the expected range include the following:

- 1993 – 1996 – Benign natural catastrophe activity

- 1999 – European windstorms Lothar, Martin and Anatol

- 2000, 2002 and 2003 – Benign natural catastrophe activity

- 2005 – Hurricanes Katrina, Rita and Wilma

- 2006, 2007, 2012-2016 – Benign natural catastrophe activity

- 2017 – Hurricanes Harvey, Irma, Maria and California wildfires

- 2018 – Japanese Typhoons Jebi and Trami

- 2023 – Benign natural catastrophe activity

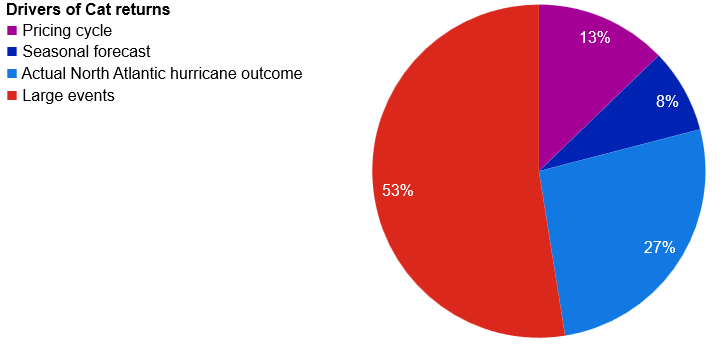

A regression analysis of these portfolio results shows in more detail the proportion in which the key factors explain the variability of the portfolio performance.

___________________________________________________________________________________________

Regression analysis is a statistical method used to understand the relationship between a dependent variable (in this case, portfolio returns) and one or more independent variables (such as the reinsurance pricing cycle, seasonal hurricane forecasts and actual hurricane season outcomes). The goal is to quantify how much each factor contributes to the variability in returns and to identify which factors are most influential.

The key findings for the Hiscox natural catastrophe portfolio were:

- Reinsurance pricing cycle: The stage of the reinsurance pricing cycles explains some of the variability in returns. For example, when the market is "hard" (higher prices, stricter terms), potential upside may improve, and losses are more tempered.

- Seasonal forecasts: The hurricane season forecasts attempt to predict levels of hurricane activity in the form of counts of named storms, classified by broad strength categories. These forecasts deviating from the long-term average does have some correlation with portfolio performance. The miss factor involved in translating storm count to landfalling, damaging storms is significant and the predictive power of the forecasts for reinsurance outcome is not strong. As a result, the forecast state only accounts for 8% of portfolio deviation from mean expectation.

- Actual North Atlantic season outcome: Years where the actual count of hurricanes in the North Atlantic differs significantly from the forecast has a more significant impact on portfolio performance, accounting for 27% of the deviation from mean.

- Large events: These constitute infrequent, extreme events - such as unusually severe hurricanes, wildfires, or other natural disasters. These events can cause large deviations from mean expected returns, often overwhelming the predictive power of pricing cycles and forecasts. As the risk underlying a natural catastrophe portfolio is inherently volatile, it is not surprising to see that the largest driver by far of deviations from historic performance is infrequent and large departures in loss activity from the long-term trend. Over half of the 53% attributed to large events is driven by losses from only four years: 1999, 2005, 2017 and 2018.

The contribution to fluctuations in returns contributed by the pricing cycle is only 13%. This may seem somewhat counterintuitive, but the pricing cycle itself is partially countercyclical to manager profitability. Soft markets emerge after periods of low catastrophe activity and positive earnings while hard markets are often precipitated by severe events. This highlights that having the ability to model and analyse pricing trends, manage relationships with cedants, and identify areas of risk and opportunity in the market, are all key to long-term, successful cycle management, which we will look at in more detail in the following section.

Levers to pull

Capital allocation is one lever available for managers to consider and use when adapting portfolio construction to shifts in the market cycle. When the market softens, portfolio managers can respond by reducing overall capital allocated, thereby limiting downside risk and preserving capacity for redeployment when conditions improve.

Another lever available to mitigate portfolio downside during softening markets is increased portfolio diversification. A portfolio that is well-diversified by geography, peril and counterparties will generally derive portfolio resilience from a lack of reliance on a single point of exposure. There is also a benefit in cycle management to being exposed to multiple pricing cycles in differing geographies and products – resulting in a dampening effect to the impact on a portfolio due to the combination of pricing cycles. For example, the drivers of market pricing in retrocession (the transfer of risk from one reinsurance company to another reinsurer) and cyber reinsurance are different and only partially correlated.

A diversified reinsurance portfolio will also typically be anchored by a core allocation to lines of business characterised by lower price volatility and more predictable results such as United States (US) Nationwide insurers. These core holdings provide stability, allowing the portfolio to weather adverse market cycles without excessive swings in performance. Around this stable core, a satellite strategy is employed – selectively pursuing opportunities by geography or product as and when market conditions become attractive. In a hard market, satellite allocations may expand to capture outsized returns; conversely, in soft phases, these exposures are pared back, maintaining discipline and capital efficiency.

Our approach to core and satellite strategies is centred around long-standing relationships with cedants. Built on transparency around portfolio appetite, these connections enable us to anchor portfolios with stable core allocations, while dynamically adjusting satellite exposures as market opportunities arise. Supported by advanced analytics and modelling, we can confidently optimise allocations, ensuring portfolio resilience.

The use of hedging also ebbs and flows across the market cycle, typically becoming more attractive as a soft market deepens and the cost of structuring protection declines. During these softer phases, portfolio managers may increase their utilisation of hedging instruments – such as catastrophe bonds, industry loss warranties, or quota share arrangements – not only because the cost of these tools drops, but also due to the enhanced structuring flexibility available.

This provides an efficient means to manage downside risk, stabilise earnings and enhance capital usage. As hedging becomes more affordable, it shifts from a secondary consideration to a strategic lever, allowing managers to fine-tune exposures and maintain capital efficiency even as risk-adjusted returns compress. While most reinsurance transactions are placed based on contracts with an annual period, a subset of the market transacts on a two- or three-year basis. While these longer duration contracts have become scarce in the recent period of market hardening – purchasers of reinsurance place enough value on having certainty of future coverage in place to be prepared to pay an illiquidity premium over the annual transactions and lock in pricing, even in markets that indicate a downward pricing trend. The benefit of locking pricing into a portfolio when the pricing forecast tends negative must be balanced against the associated illiquidity and risk of missing upward market repricing post-event.

We pride ourselves on taking a transparent approach with our capital partners. This includes openly sharing the levers we adopt in the management of our own portfolio at the various stages through the market cycle. ![]() Approach depends on objective

Approach depends on objective

The approach to navigating the market cycle is intrinsically shaped by the primary objective of the portfolio manager, and capital allocation forms the fulcrum upon which strategic decisions are balanced. Broadly, three distinct philosophies can be identified, each with its own risk-return profile and tolerance for volatility: the constant exposure approach, the hard market approach and the cycle-managed strategy.

The constant exposure strategy prioritises stability above all. By maintaining a steady, unwavering level of capital allocation throughout the cycle, it minimises the portfolio’s volatility by avoiding over-allocation, shielding the portfolio against the most dramatic fluctuations in returns. This approach is particularly favoured by those for whom predictability is preferred, such as stakeholders with strict solvency requirements or less appetite for downside risk. This conservatism does sacrifice the possibility of outsized gains when market conditions become favourable again, opting instead for a reliable – if muted – performance.

At the opposite end of the spectrum lies the hard market approach, which embraces the dynamic nature of the cycle. Here, portfolio managers swing capital allocations aggressively in and out of the market, seeking to maximise upside potential during periods of pronounced price hardening. This strategy can deliver impressive returns when market pricing is elevated, and structuring regimes are in the favour of capacity providers. This approach does demand a robust tolerance for risk, as over-allocation to volatile conditions can result in sharp drawdowns should event losses spike. The hard market specialist must be able to both seize fleeting opportunities, and ride-out losses from large events. Heightened event activity during periods of market hardening will typically prolong periods of favourable market conditions.

Between these two extremes is the cycle-managed strategy – a nuanced, adaptive approach that flexes capital allocation, hedging strategy and areas of portfolio focus in response to the ebb and flow of market conditions. Managers employing this philosophy seek a balance: capturing the upsides of hard markets through increased allocation, while scaling back and taking a more nuanced approach to hedging strategy during softer phases to preserve capital and manage volatility. This method requires careful analysis and timing, leveraging market intelligence and predictive signals to achieve target returns without unduly exposing the portfolio to event risk. Over the medium term, such disciplined management allows the core signal of the pricing cycle to override the unpredictable noise of catastrophic volatility, delivering a measured blend of growth and resilience.

Ultimately, the chosen approach reflects both strategic intent and risk appetite. Whether the goal is stability, maximising upside, or balanced performance, capital allocation remains the manager’s most potent instrument in steering the portfolio through the shifting contours of the reinsurance cycle. We work with investors across a wide spectrum of risk profiles and as a manager, we actively listen to our clients’ needs and construct optimal portfolios according to their mandates. We have a proven track record of delivering results against each of the strategies for our capital partners.

A cornerstone of our managerial philosophy is transparency, and we share Hiscox Group’s approach to allocating its own capital during different phases of the market cycle with investors. As a reinsurance company, our risk tolerance can differ from our capital partners, but we pride ourselves on transparently communicating our strategic position.

Conclusion

A nuanced understanding of the reinsurance cycle requires not only vigilance, but also the ability to anticipate the implications of macro and micro drivers across a portfolio’s composition. Strategic asset allocation, diversification across perils and geographies, and the careful calibration of retention levels are all essential tools in the portfolio manager's arsenal. An agile approach enables insurers and reinsurers to respond rapidly as the market pivots between soft and hard conditions, adjusting treaty structures, layering, and ceded limits to optimise outcomes. The capacity to recognise early signals – such as tightening capital markets, shifts in regulatory requirements, or emerging risks from climate change and technological disruption – can provide a competitive edge, allowing managers to seize opportunities or buffer portfolios from adverse developments.

Risk modelling and scenario analysis further equip portfolio managers to simulate the impact of a range of events, from benign to extreme. By stress-testing portfolios against historical and hypothetical catastrophes, managers can develop a robust understanding of tail-risk exposure and volatility, informing decisions on pricing thresholds and coverage limits. In hard markets, a disciplined approach may entail reducing exposure to higher-risk territories or perils, while in softer markets, enhanced selectivity and negotiation can preserve margins and protect against the erosion of underwriting standards. Ultimately, effective management of the reinsurance cycle demands a blend of quantitative acumen, market intelligence, and strategic foresight – a dynamic combination which determines not just the profitability, but the resilience of the portfolio over time. Partnering with a manager that has deep underwriting capabilities, internal analytical resources, and superior market access also sets investors up for long-term success. At Hiscox, we have been developing specialty insurance solutions for over 100 years, and we have a long and proven track record within the industry. As a result, our integrated model enables us to deliver positive returns for our capital partners across all phases of the market cycle.