Read the rest of the post ' Hiscox Re & ILS becomes Hiscox Re and launches Hiscox Capital Partners '

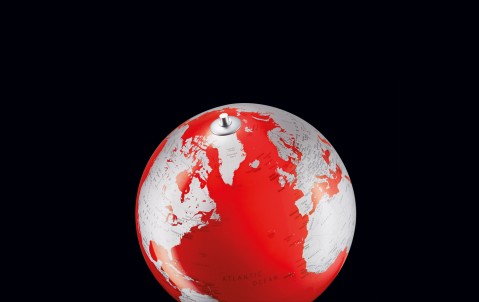

Climate change: opportunity knocks for the reinsurance industry

This article was originally published in the winter issue of Insider Quarterly.

Matthew Swann, Principal for Hiscox ILS and Daniel Vestergren, Chair of International for Hiscox Re believe the reinsurance business is well placed to tackle the impacts of climate change, but it will need all stakeholders to pull together.

As a candidate for one of the clearest, nailed on symptoms of climate change, wildfire is doing a convincing job. According to the Insurance Information Institute, the top five costliest US wildland fires in terms of insured loss took place in 2017 and 2018.

For the reinsurance industry, wildfire and the wider consequences of climate change pose a tricky problem but one that represents as much an opportunity as it does a threat. Take a step back for a moment to assess the industry’s position: as a provider of capital relief for tail risk scenarios, reinsurers are already well equipped to consider climate change, drawing on a set of tools based on physical modelling that are unlike just about every other part of financial services where models tend to be rooted in statistics. That is a crucial difference. Added to that, there are plenty of people in the reinsurance world already thinking about how to respond to the impact of climate change.

No one is in denial

You rarely find people in the reinsurance industry who are either ignorant of the climate change problem or in denial. Reinsurers sell a product that responds to extreme events and so even slow underlying climate trends can amplify the expected loss-cost to those tail risks. This makes climate change a more immediate concern for the industry, and making sure the industry is up to date in its assessment of the climate risk is critical.

For some catastrophe perils, like earthquake, climate change has no bearing, while for others such as wildfire and flooding it is having a significant part to play. Other atmospheric perils like hurricanes and wind storms sit somewhere in between those two extremes and it’s not yet known how climate change will affect them. That said, scientists can ask questions like “was 2017’s Hurricane Harvey made worse by climate change?” They see evidence that “yes”, climate change is having an impact on translation speeds of hurricanes; the amount of water they can hold and the amount of rain they can dump on any one area. In the case of Harvey, the flooding was exacerbated further by the concrete sprawl of Houston.

What is certain however is that while climate models might predict a range of different outcomes, they are starting to agree on certain trends and, on balance, the reinsurance industry should accept that the climate risk is going to be elevated.

A model answer

The good news is, when it comes to underwriting and pricing climate change risk, the reinsurance industry has developed a sophisticated way of thinking about tail risk, particularly through the use of catastrophe models from external vendors. Though often maligned, these models have a key role to play but there is still room for them to evolve. For example, could the models develop the capability to say this is current climatology, this is historic climatology, this is the forward projection and this is the difference in the answer? The improved visibility would give the underwriter more scope to engage with their broker and client to say “we think this baseline risk is changing and we need to prepare for it, as do you.”

The vendor cat models are the accepted currency for the reinsurance industry and if they can reflect changes to the baseline risk, then they will help drive a sustained industry wide increase in pricing that more accurately captures the changing climate change risk. Wildfire pricing has shifted upwards by significant percentages in the last few years for some of those risks, but that's reactive and the ‘out of the box’ models are not necessarily capturing all the things underwriters need to help them be more proactive. Of course, most reinsurers will overlay their own view of risk on the third party models, but the industry shouldn’t simply be relying on reinsurers to do this; climate change is creating a greater risk of catastrophic weather events in both frequency and severity, and the vendor models must reflect that to both deliver the long term pricing the reinsurance industry needs and also help drive up demand for the reinsurance product.

Uninsurable

What if it transpires that all the modelled projections say that in ten years from now a climate related risk like wildfire is going to be uninsurable? It could be argued that this in itself is a valuable insight to take to the wider community to help stop inappropriate development in areas of brushland for example, or to drive better forestry management, or better control of the power grid. Everyone sees it as a threat but there is an extraordinary opportunity for the industry to help build in better resilience to climate change risks by forcing people, businesses, and government to acknowledge that there is a cost. This work can highlight how these risks will change, what they will cost and either bring in new forms of capital to harness that volatility – which of course is what ILS is all about – or mitigate the risk, or reprice, or do all three. Reinsurers must be explicit with stakeholders about understanding the threat – which is where the model vendors play a really important role.

Other industry stakeholders can also help drive that transparency. Take capital partners who want to see complete disclosure in any risk they back; they want good governance, and they want insight into the pricing and to know that the models aren't broken. The industry should welcome that forensic examination of risk. Capital partners control trillions of dollars of assets under management and their sole focus is generating a return far into the future – a much longer-term horizon than corporates, governments, and individuals. They ask the big questions and are well placed to push the industry to do better. It's a potentially exciting partnership.

Rising to the challenge

Climate change is not an insurmountable challenge for the reinsurance industry. With access to insightful tools to understand and unpick climate risk, reinsurance has both the means and the motive to build a sustainable view of risk into the future. A changing baseline risk also represents opportunity, and we should prepare for greater demand for our products. The industry must work more closely with primary insurers to development new solutions such as parametric covers that can respond to climate change related risk, drawing on insurers’ client knowledge to build up a close understanding of clients’ needs. Can the industry also come up with products that are cheaper to manage and buy, while also being quicker to respond? Get these relationships and products right and – together with help from the cat modelling industry – reinsurance has both the means and the motive to step up to the challenge.