Read the rest of the post ' Managing the reinsurance cycle '

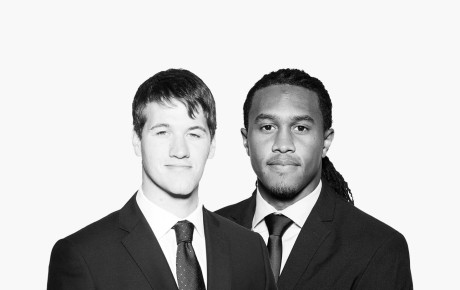

Talent focus: Patrick Daniell, Underwriter, Hiscox Re & ILS

Patrick Daniell, International Underwriter at Hiscox Re & ILS, shares how he made the leap from broking to underwriting, the biggest challenges in his role and how his background in engineering led to a career in reinsurance.

A few years ago, you made the leap from broking to underwriting. What inspired you to switch lanes?

I really enjoyed my time as a broker. There’s a thrill that comes from fighting hard for a client and successfully persuading an underwriter to support a programme. I found it particularly rewarding working with smaller clients as if you’re able to secure them a good programme or price, it can make a significant difference to their company. I also enjoyed the buzz and collaborative environment of Lloyd’s (something I miss even more now we’re stuck at home!).

Although I loved the fast-paced nature of the role, I wanted to get a more global view of the reinsurance market, as well as understand the perspective from the other side of the negotiation table. When the opportunity came up to work within the International reinsurance team at Hiscox – a company I’d always respected – it felt like the perfect time to make the shift!

As an underwriter and owner of the risk, you have more responsibility to choose the right deal as it has implications on the whole business. You also need to ensure the individual contracts are contributing towards a profitable and balanced portfolio, which I find extremely stimulating as it’s ever-evolving. I enjoy the collaborative working style. Everyone at Hiscox Re & ILS is on the same team and we’re all working towards one goal.

You completed a degree in civil engineering from the University of Cambridge. How did this lead to a career in the reinsurance industry?

It might not seem like the obvious application of what I learned at university but there’s actually a logical path to reinsurance!

During and immediately after university, I put my degree into practise at a structural engineering consultancy firm who specialised in office and commercial building design. While I enjoyed the problem-solving side of engineering, I quickly realised that the strict design codes and regulations meant that there wasn’t as much room for innovation as I liked. I wanted to find something that was more focused on ‘first principle’ thinking – deconstructing the problem down to its core elements and building a solution from there.

Following this role, I landed my first reinsurance-specific position at Aon within the Impact Forecasting Team. As an engineer, my job was to work alongside various scientists (seismologists, hydrologists, meteorologists) to estimate how much damage would be done to buildings if a severe earthquake, flood or hurricane hit – a kind of ‘reverse engineering’. Once I’d done that for a few years, I wanted to see how and where the models were used in practice, which inspired my shift into broking.

What are the biggest challenges in your role?

In my view, iteration is often overlooked in favour of innovation. Often the hardest challenge is taking something that already exists (our portfolio) and analysing, critiquing and refining it to create a solution that meets both our client’s needs whilst also ensuring we’re optimising our own book of business. To me this is incredibly stimulating, as it harks back to the ‘reverse engineering’ thought process I enjoy so much.

Another key challenge for me is perfecting the balance between analytics and underwriting in final decision making – the often discussed art vs. science of underwriting. There’s no doubt that the industry is becoming more analytical and at Hiscox Re & ILS, we have a fantastic working model where underwriters work hand in glove with an incredibly talented group of modelling and research experts. The depth of knowledge that we have access to is second to none and the combination of science, engineering knowledge, and statistical data that goes into the modelling process is absolutely critical to making sound underwriting decisions.

Where the rubber really meets the road is how the underwriter uses this information, alongside all the other critical factors, that you can’t always capture in a model (current economic environment, market trends, business track-record, socioeconomic implications), to make a call on whether a specific deal is priced correctly.

What has been your most eye-opening moment in your role?

Coming from a broker background, I think the most eye-opening thing for me has been seeing difference in broking styles. Due to the nature of the book I oversaw and my background, I’d class myself as quite a technical broker – negotiating based on modelling, statistics and performance. Now that I’m on the receiving end as an underwriter and have a more global perspective, I understand that there are some areas of the world where data quality is poor or modelling just isn’t available, which means broking in specific markets must be driven by relationships and experience. This was a real eye-opener and a change in perspective for me.

If you had chosen a different profession, what would it have been?

I’ve always fancied doing something in Formula One. I’ve followed the sport since I was young and love both the technical side of it as well as all the fanfare. Obviously being a driver would be the top choice, but being an engineer in the pit lane would be pretty cool too.

Do you have any special morning rituals that help you mentally prepare for the day ahead?

Take the dog for a walk and a tidy inbox!